Softek Hub delivers secure, scalable core banking software enabling banks and financial institutions to manage operations efficiently with real-time processing, accuracy, and seamless digital transformation.

Our core banking solution empowers institutions to deliver faster services, centralized data access, and consistent customer experiences, while supporting compliance, reliability, and operational excellence across all channels, products, and touchpoints in an integrated, scalable, and secure banking ecosystem worldwide today.

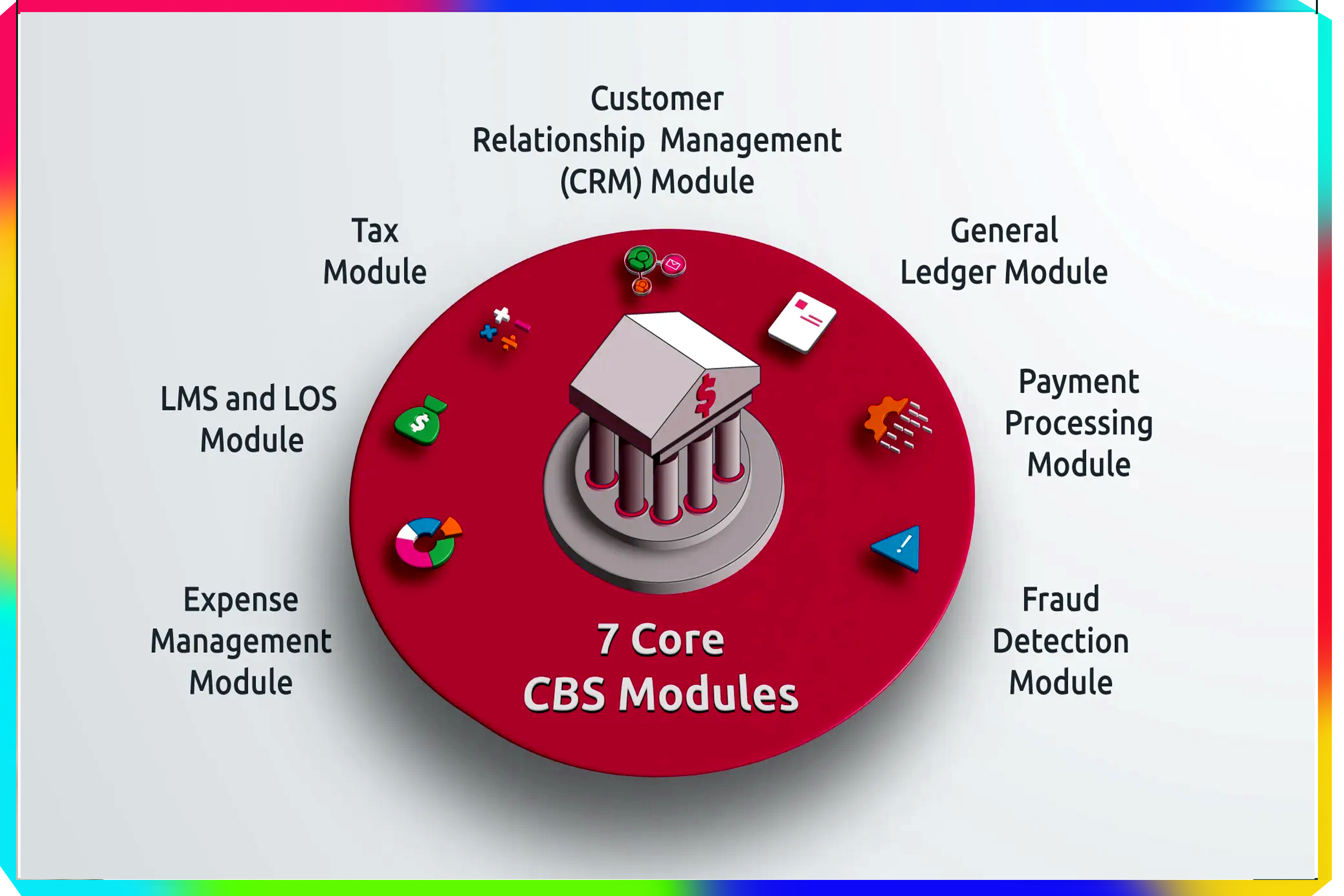

Core banking software is a centralized technology platform that enables banks and financial institutions to manage customer accounts, transactions, loans, deposits, and payments in real time. It connects all branches and digital channels, ensuring data consistency, faster processing, improved security, regulatory compliance, and seamless customer experiences. By automating core banking operations, it helps institutions operate efficiently, scale easily, reduce costs, and support modern digital banking services across multiple touchpoints.

Member management, savings and loan tracking, automated interest calculation, secure data handling, customizable reports, regulatory compliance, and user-friendly interface dashboard.

Member registration and profile management, KYC and document storage, Member account history tracking

Savings account management, Fixed Deposit (FD) and Recurring Deposit (RD) handling, Automatic interest calculation

Loan application and approval process, Multiple loan types support, EMI and interest calculation, Repayment tracking and overdue alerts

Automated ledger and voucher management, Day book, cash book, and bank book, Profit & loss and balance sheet generation

Member-wise and loan-wise reports, Interest, recovery, and outstanding reports, Customizable reports for audits

Role-based user access, Secure data encryption, Regular data backup options

Softek Hub understands the operational challenges faced by Core Banking. Our software is designed with flexibility, reliability, and ease of use in mind.

✅ Customizable solutions for banks and NBFCs

Improves efficiency, accuracy, transparency, compliance, security, member service, and overall cooperative productivity.