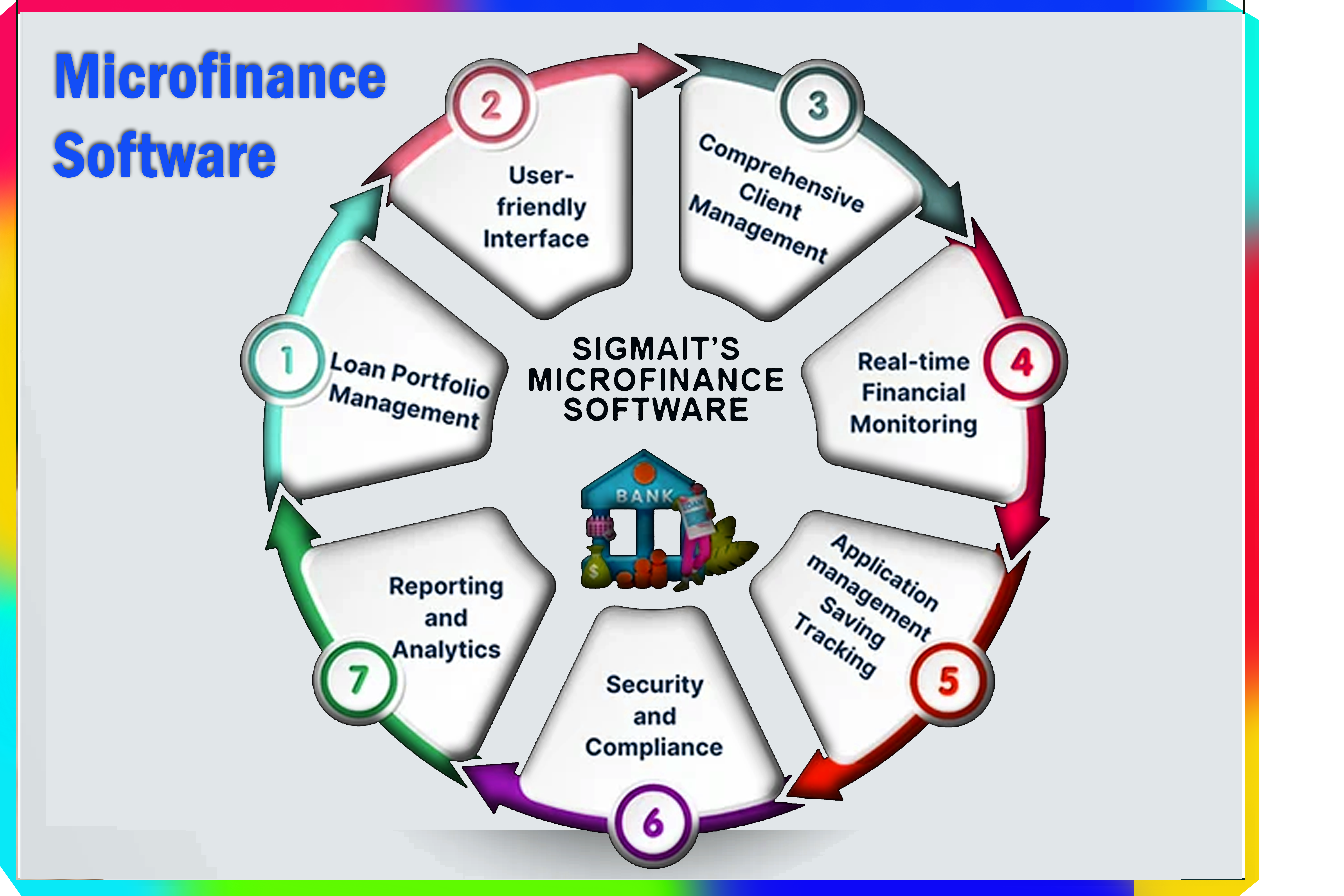

Microfinance software from Softek Hub streamlines loan management, client onboarding, and repayments through secure, scalable technology. It empowers institutions to reduce risk, improve transparency, and deliver faster financial services to underserved communities with accuracy, compliance, and real time insights globally.

Softek Hub provides customizable, cloud ready microfinance software supporting savings, credit scoring, reporting, and analytics, enabling secure compliance, user friendly operations, and sustainable organizational growth.

Microfinance software is a digital solution designed to manage loans, savings, clients, and repayments for microfinance institutions. It automates daily operations, reduces manual work, improves accuracy, and helps organizations efficiently serve low-income individuals and small businesses. Microfinance software is used to simplify loan management, track repayments, manage customer data, and generate reports. It ensures transparency, saves time, minimizes errors, and helps institutions scale operations while maintaining compliance and financial control.

Accurate, time-saving, error-free, transparent, centralized, easy, secure, efficient, reliable, automated, convenient, organized, insightful, accessible, scalable.

Simplifies loan disbursement and repayment tracking efficiently.

Automatically calculates interest and penalties accurately.

Maintains customer and account data in one place.

Delivers instant reports for better decision making.

Minimizes operational expenses and manual errors.

Ensures transparency and adherence to regulations.

Softek Hub provides secure, easy to use microfinance software. It helps organizations manage loans, customers, and reports smoothly, reduce manual work, improve efficiency, and promote financial inclusion through modern technology, reliable performance, and dedicated expert support for growing financial institutions.

✅ Mobile-friendly interface