Softek Hub’s DSA Loan Management Software is designed to streamline operations for Direct Selling Agents by managing leads, applications, commissions, and lender coordination through a centralized, secure, and easy-to-use digital platform.

Our solution helps DSAs improve productivity, reduce manual errors, and track loan journeys efficiently while offering real-time visibility into application status, payouts, performance metrics, and customer data across multiple lenders.

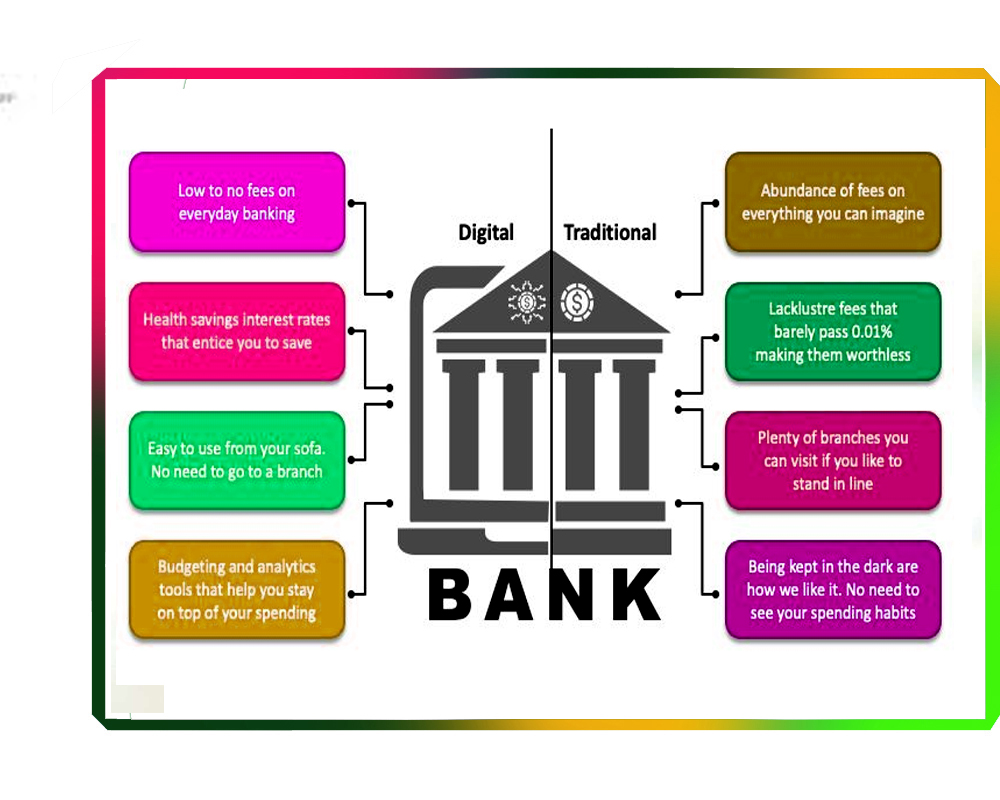

Core banking software is a centralized system that lets banks and financial institutions manage customer accounts, transactions, loans, deposits, and payments in real time. It connects all branches and digital platforms, ensuring faster processing, data consistency, security, and compliance, while enabling efficient operations, cost reduction, scalability, and seamless modern banking experiences for customers across all channels.

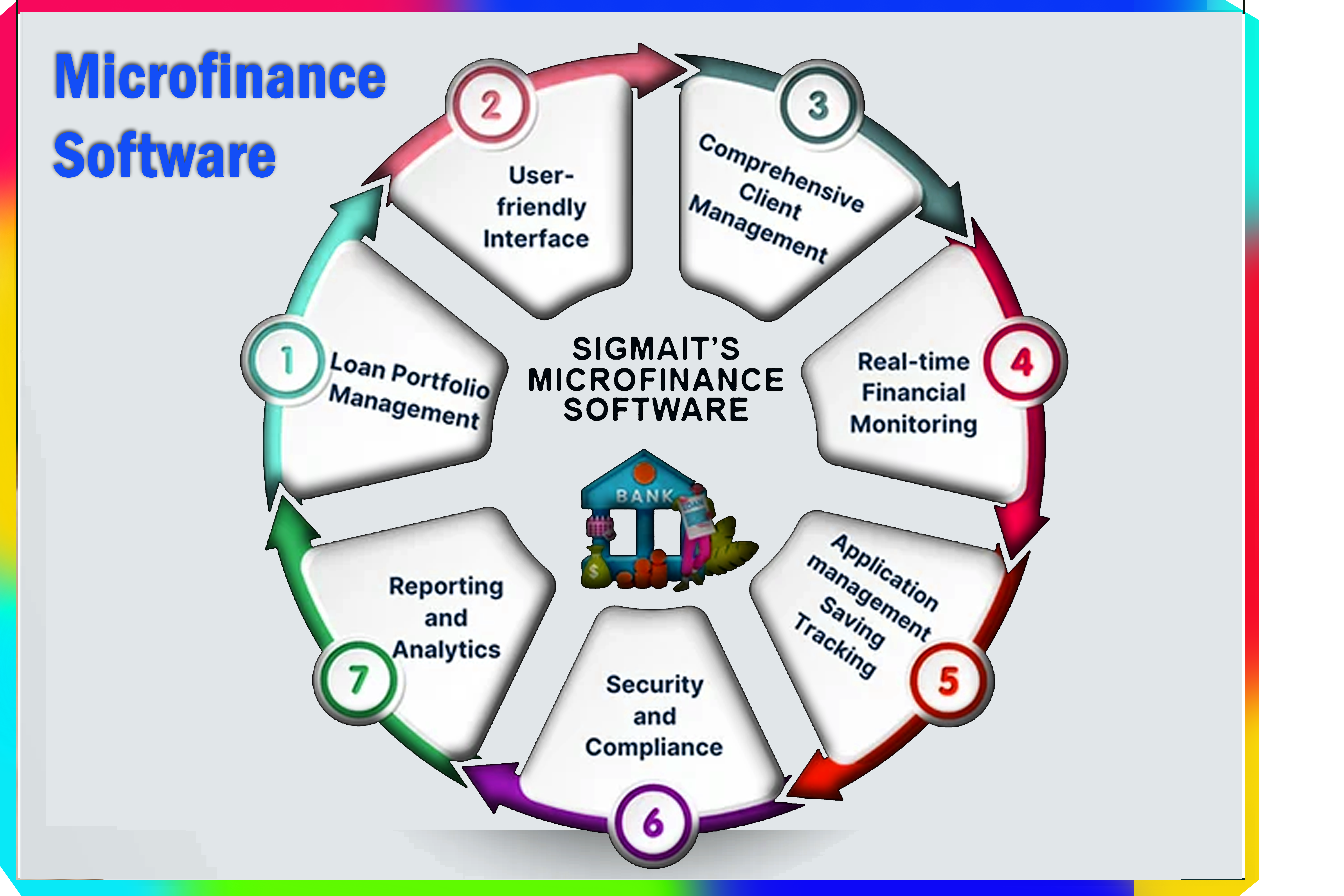

Member management, savings and loan tracking, automated interest calculation, secure data handling, customizable reports, regulatory compliance, and user-friendly interface dashboard.

Collects and assigns leads efficiently to agents.

Controls system access by user roles.

Tracks applications across multiple lenders in real time.

Secure, scalable cloud-based system infrastructure.

Calculates payouts automatically, reducing errors.

Streamlines client onboarding and document management.

Provides real-time data and analytics.

Connects seamlessly with lenders and CRM platforms.

Softek Hub understands the operational challenges faced by Core Banking. Our software is designed with flexibility, reliability, and ease of use in mind.

✅ Lead capture and assignment system

Improves efficiency, accuracy, transparency, compliance, security, member service, and overall cooperative productivity.